Contact

02.12.2023Your Homeowners Insurance Policy Likely Needs To Be Increased

02.12.2023[ad_1]

There’s a saying that goes something like this: To feel rich, take whatever you earn and triple it. Once you get there, triple it again. In other words, due to hedonic adaptation, it’s impossible to ever permanently feel rich!

We all know that making a top 1% income or top 0.1% income means you are technically rich. But I’ve noticed on my path to financial freedom there were several times when I felt incredibly rich and money wasn’t the dominant reason.

Let me share some of those times in this post. I’ll also share more classical ways I felt rich.

Maybe you can share some of the times you felt rich as well. The more we can show gratitude for how far we’ve come, the better we’ll feel.

When Do You Finally Feel Rich?

Looking back, here are some examples when I finally felt rich. Each moment of richness felt a little different and lasted for different lengths of time. I think these type of moments will make you feel rich as well.

1) When you visit a lower-cost country.

I used to live in Malaysia from 5th grade to 8th grade in the early 1990s. At the time, the exchange rate was ~2.3 Ringgit to 1 USD. When I finally paid a visit more than 20 years later, the Ringgit had depreciated to 3.7:1. One Ringgit bought the equivalent of $1 worth of stuff in the States.

Therefore, I suddenly had almost 4X the amount of purchasing power during my week-long stay. So perhaps making 3X more doesn’t really make you feel rich, but making or having 4X more does!

In addition to the increased purchasing power aspect, it felt particularly moving to visit my old house. It was overgrown with weeds. All the rich memories came rushing back of me skateboarding in my driveway and inviting friends over for fun.

It also felt good to realize I didn’t fall through the cracks. Back in middle school, I was an undisciplined kid who got into way too much trouble. If I was my own father, I’d have considered sending myself to military school.

Unfortunately, within a couple weeks after returning to the United States, I no longer felt richer than normal. I can completely understand the lure of being a digital nomad in a place like Malaysia, Thailand, or Vietnam. In a different life, being a digital nomad is exactly what I would have been.

2) When you finally hit your passive income target.

It took 17 years to achieve my passive income target of $200,000. When I finally got there, I felt rich. There was little fear of running out of money anymore.

That said, growing up in developing countries where there was a lot of visible poverty and experiencing many boom bust cycles working in finance has permanently made me a little paranoid about losing everything.

Passive income feels like free money because you’re not doing much to earn it. In a way, you almost feel guilty, even though you spent a tremendous amount of time building your passive income portfolio in the first place.

The amount of passive income generated is less important than whether or not it can cover all of your living expenses plus a nice cushion. Once it can, you will feel rich.

Another reason why you will feel rich once your passive income is high enough is because you can finally freely speak your mind. You don’t have to suppress your true opinions about anything. You’re less concerned about displeasing somebody. You’re also not afraid to lose your job any longer.

Curiously, once we had our son in 2017, $200,000 no longer felt like enough. With the cost of health care, housing, and college education rising far quicker than inflation, I felt like I needed to generate more passive income. There must be some type of biological trigger that switches on once people have a child.

Today, with two children, our passive income target is now $300,000. We’ll make it work on less. However, if I want to feel rich, I require at least a 20% buffer over our expenses.

3) When a new income stream comes out of nowhere.

None of us are maximizing our income potential. If we could make a maximum of $100 a month, I think most of us are really making only an average of $30 a month. It’s kind of like how none of us utilize more than 20% of our brains. If we did, perhaps we’d find a cure for all cancer already.

One of my issues for years was not caring about revenue maximization on Financial Samurai. I already had enough passive income. Therefore, I wasn’t constantly hustling to find new business deals. When some of my peers would hire a team of writers to write affiliate posts, I was busy focusing on writing about fun topics that made little-to-no money.

But in 2018, I decided to become more entrepreneurial because I received poor feedback on a post I spent a lot of time on. I figured, if people didn’t really care after reaching my 10-year anniversary, then I might as well start being selfish for myself. Besides, I had a baby boy to take care of.

Today, I feel rich whenever a new income opportunity appears on Financial Samurai when I’m not looking. I’m trying my best to be more entrepreneurial until we reach herd immunity. But I’ve gone from running through the finish line to walking by taking a sabbatical right now.

I think many of you are feeling burned out as well. Experiencing surprise income opportunities online are no longer as exciting. Things are getting better and my little ones are growing up quick.

4) When you don’t sell assets at suboptimal times.

Back in 2012, I listed my San Francisco single family house for $1,700,000. I didn’t get any official offers, only whispers from a couple real estate agents saying their clients were willing to pay closer to $1.4 – $1.5 million. I refused and took it off the market until mid-2017.

My tenants had given me their 30-day notice. I figured I might as well test the market for both rent and sale again. My hope was to get at least $2,300,000 or $8,800/month, the same rent as my previous tenant.

Instead of getting $8,800/month, the best I could get was $7,500/month, a big 15% decline. At the same time, my realtor found a prospective buyer off-market who offered $2.6 million! After much back and forth, I was able to get the prospective buyer up by $140,000. Just by waiting five years and living my life I was able to get much more.

Not selling an asset at a bad time will make you feel richer as time goes on. The reason why is because the compound returns grow even greater. At the same time, selling at an inopportune time makes you feel poorer and poorer.

The only way to counteract the bad feeling of selling at an inopportune time is if you reinvest the proceeds in other appreciating assets. For the first 6-12 months, I felt a little melancholy having sold a home I had owned for almost 13 years. I had dreamed of starting a family in the home.

But thankfully, the reinvested proceeds provided a positive return, so it worked out in the end. Dealing with five male tenants who perpetually threw house parties was just too much.

Holding On To Something You Created

Perhaps more important than not selling an asset you did not build is not selling an asset you did build. I feel rich for not selling Financial Samurai back in 2018.

Back then, I was very tempted to because I was overwhelmed with fatherhood. I had a couple suitors offer healthy seven figure payouts. However, I wanted to reach the 10-year mark in 2019 before doing anything drastic. The site has since collected three years more of revenue and valuations are even higher thanks to a bull market.

In a low interest rate environment, you want to hang onto your income-producing assets for dear life. Any business that can operate unimpeded during a pandemic has also become more valuable. I see online businesses only getting more valuable over time. If you sell a cash cow baby, you will likely be filled with regret.

Further, Financial Samurai gave me something meaningful to do while I was stuck at home during the pandemic. I’m focused on keeping the site going so my kids can have a repository of thoughts about their dad when they are older.

5) When something comes true after trying for so long.

The longer you spend working on something, the richer you will feel once you succeed. This is where feeling rich really doesn’t have to do with money. It has to do with the satisfaction of gutting things out.

This rich feeling is why you don’t want to just give your children everything. It’s better to make them earn their success. Please don’t envy the person who inherits everything. Feel bad for them instead.

Here are some good examples that take a long time to achieve, but once you do, you will feel rich:

- Studying for the MCAT, LSAT, Bar Exam, CFA, and passing.

- Writing a book for years and finally getting it published

- Working on building a relationship with a client for a year and the client finally agrees to do business

- Coaching your players for three years and finally winning a championship

- Dating for eight years and finally finding the one

- Trying to have children for years and finally giving birth to your first child

- Practicing for hours after school and finally making the team

- Diligently saving and investing for years until you finally come up with a down payment for a house without any help from your parents

Delaying gratification and demonstrating grit go hand-in-hand. It’s very hard to appreciate something if it’s just handed to us.

6) When You’re Surrounded By Loved Ones

Friends and family are everything. Having friends to joke around with brings so much joy. Having family that supports you in your endeavors feels priceless. We recognize this importance now more than ever before.

As a father of two young children, I feel richer than before I had children. It took years to conceive our first. Then to have another a couple years later felt like a miracle as older parents. Seeing them for the first time made me feel like the richest person ever. Every morning I wake up excited to give my children a hug.

I wish someone told me in my 20s and early 30s that having children would provide so much love. If I had been told, I would have tried to have children at least five years sooner and not been so focused on trying to achieve financial independence. But I also realize raising young children is incredibly difficult.

If we could not have children, then we would spend more time nurturing friendships and adopt. Great relationships mean so much more than having a lot of money.

My main hope now is that my parents check in more often. The pandemic has ruined creating a relationship with their grandchildren. I’m pleased to say after 23 months, I finally flew to Hawaii to see my parents. It felt very special and I plan to see them three times a year from now on.

7) When You Become A Time Billionaire

A time billionaire is someone who has full mastery of his or her time. There’s no greater feeling of wealth than being able to do whatever you want, whenever you want.

Even after my income plummeted by 80% once I left my day job in 2012, I felt richer. Sure, the unknown was a little scary. The first couple of months of not having a paycheck felt a little painful. But I was excited to have taken the leap of faith while I was still relatively young.

Being able to sit in the park and read a book on a Wednesday afternoon is nice. Being able to conquer your FOMO that you should be out there hustling for more money is truly rich.

Once you experience being a time billionaire, you will no longer be willing to grind as hard at work or at building a business or climbing up the corporate ladder. Some would saying being a time billionaire is even more valuable than being a financial billionaire.

8) When You Wake Up Each Morning Without Any Ailments

One of the biggest epiphanies I had after leaving work was that I had internalized all my chronic pain. I just lived through my TMJ, teeth grinding, allergies, sciatica, plantar fasciitis, lower back pain, and tennis elbow for over a decade. Then, about a year after I retired from finance, practically all my chronic pain went away!

Some of us work in such stressful occupations that we forget what living a pain-free life feels like. I remember seeing my first gray hairs at 33. The dam had finally broke, I had thought to myself.

But 12 years later, the gray hairs have not returned. I suspect the reason is because I’m truly less stressed on average each day. The health benefits of early retirement are priceless. And the body tends to tell the truth about how you really feel, no matter how much you try and say otherwise.

Unfortunately, I’ve noticed more random physical issues that are nagging me as I’ve gotten older. If it’s not a sore lower back, it’s a rickety shoulder, or an itchy ear. Most of these problems have to do with me playing sports too often.

Now I wonder whether being unathletic is better for living longer and having a more comfortable life. At the extreme, you hear about major health problems to NFL players. To live a rich life means living a pain-free life.

Cherish your health and your youth folks. You not only want to have full control over your time. You want to have full control over your time while you are healthy.

This means travel and explore while you can. Have the time of your life in your 20s and 30s. Health issues will inevitably pop up as you get older.

9) When You Learn Something Meaningful For Free

I love the internet because you can learn practically anything you want for free. You just have to focus your time reading and watching sites that are most helpful.

And because I love learning things for free on the internet, it’s only right to share on Financial Samurai what I’ve learned along my journey as well.

It feels good to help people on personal finance matters without a paywall. Money consistently ranks as a top 3 stressor in people’s lives. If I can help strangers solve difficult problems or give readers the courage to act, it feels very satisfying.

2020 was a difficult year for millions of people. 2021 has so far been better due to incremental progress. During the darkest times, it felt good to regularly publish posts and write more nuanced newsletters to help folks through.

I thought about creating a paid newsletter, but I think it’s awesome to learn something for free. That makes me feel rich and I hope it makes you feel rich too.

10) When You Buy Something At An Opportune Time

Now that over a year and a half has passed since the start of the pandemic, I feel rich because things have recovered so much. Let’s never forget how dicey things were between March – June 2020!

In 2020, it wasn’t just our investments taking a dive, but our day-to-day lives as well. To be able to sit here today with so many asset classes up so much feels like a miracle. We really need to be appreciative of our good fortune.

Further, some of us were able to buy some stocks near the bottom. After writing, How To Predict A Stock Market Bottom Like Nostradamus on March 18, 2020, I decided to invest around $250,000 in various stocks and indices. I didn’t hold onto my entire position until now. But I still feel rich for not panic selling.

Lucky To Connect The Dots

During the stock market meltdown, I also did an analysis on how real estate gets impacted by a decline in stocks at various levels of decline. My conclusion was to buy real estate when the S&P 500 was down between 15% – 20% for various reasons I highlighted in the post.

As fate would have it, one of my favorite homes came to market in early-April 2020, when the S&P 500 was down 15% – 17%. My son and I had walked by the home over 50 times during our neighborhood walks.

Every time we walked by, he would always run up and marvel at the double wide garage door. He’d also get a kick out of playing with the springy hose that hung off the fence.

The lockdowns were only one month in when they listed the home. Public open houses were shut down and many prospective homebuyers were too nervous or unmotivated to arrange private showings. One thing led to another and I managed to get a deal on our latest forever home.

Buying a larger home during the summer of 2020 makes me feel rich. As a father, my #1 responsibility is to take care of my family and provide them the best life possible.

With no in-person preschool for 15 months, the extra space made a huge difference in all our well-being. Just seeing my son run around in his new play area makes me feel so happy to have taken the investment risk. It certainly wasn’t easy to pull the trigger when there was so much uncertainty.

11) When You Discover Easier Ways To Make The Same Amount Of Money

The baseline way most people make money is working at a job. Trading time for income is what most of us get taught. However, as you discover easier ways to make money, you’ll feel richer because you’re getting a greater reward for the same amount of time or less.

For example, making money by owning physical real estate is one of my favorite ways to make money. While working, I invested the majority of my savings into real estate because I wanted the double benefit of capital appreciation and rent appreciation. Earning money as a landlord was much easier than earning money working in banking.

When I started investing in real estate crowdfunding in 2016, it became easier to make money than being a landlord. No longer did I have to deal with maintenance and tenant issues because the income was 100% passive. All I had to do was diversify my online real estate portfolio properly and do my taxes each year.

Find easier ways to make the same amount of money with less effort or more money with the same effort. Most of the time, the answer lies in investing. However, learning how to utilize leverage will make you feel rich.

12) When You Are Free From Gatekeepers

The Novak Djokovic Australian Open saga reminded me that no matter how rich you are, if you still have a gatekeeper preventing you from getting what you want, you aren’ completely rich. Now, Novak’s legacy is tarnished because 71% of Australians wanted him expelled because they thought he was selfish.

It is much better to only be rich and not famous. This way, you can do what you want without constant scrutiny. Further, to get richer, you must lessen your desire for things and be happier with what you want.

Once you get ride of the gatekeepers, this is when you will truly feel rich.

Feeling Lucky And Grateful Makes You Feel Rich

The common theme to feeling rich is when you start feeling lucky. We can all work very hard to try and get rich. However, I truly believe luck is the main reason why some people are able to amass much more wealth than others. They either were lucky to meet the right people, have the right parents, or be in the right place at the right time.

Spend some time going through your lucky breaks. The more you are aware of your luck, the richer you will feel.

Luck makes you feel rich because it makes you feel like you got something for free. That or luck makes you feel like you got something you didn’t fully deserve.

A couple of my other lucky breaks include:

- Getting into The College of William & Mary and meeting my wife my senior year. If I had attended the University of Virginia or had been one year older, I never would have met her.

- Getting handed the phone by my VP. On the line was a recruiter who ended up getting me a job at a competitor three months before I was to be laid off. That phone call brought me to San Francisco in 2001.

Of course, I’ve also had plenty of bad luck and failures along the way. Perpetual failure is the main reason why I continue to save. However, by focusing on the lucky breaks, I feel richer.

Other Examples Of When You Might Feel Rich

- If you walked away from a car accident unscathed.

- If you find a $100 bill on the ground with nobody else in sight.

- If both of your parents live long enough to hold their grandchildren.

- If you were diagnosed with a terminal disease and are still living past your due date.

- If you found the love of your life early.

- If your job is something you’d happily do for free or for much less money.

- If you’re making a difference in other people’s lives and also getting paid.

- If you were a C-student who now lives an A-lifestyle.

- When your investments return more than your income.

- When you survive a global pandemic with your health intact.

If you focus only on an absolute dollar amount, you’ll never truly feel rich. There will always someone with more money than you.

I have friends who are worth over $100 million who keep grinding because some of their old peers are now worth over $1 billion. Can you imagine?

Therefore, if you can focus on your lucky breaks and all the good fortune you are currently experiencing, you will feel like the richest person in the world. Please take nothing for granted!

Feeling Rich, Staying Rich

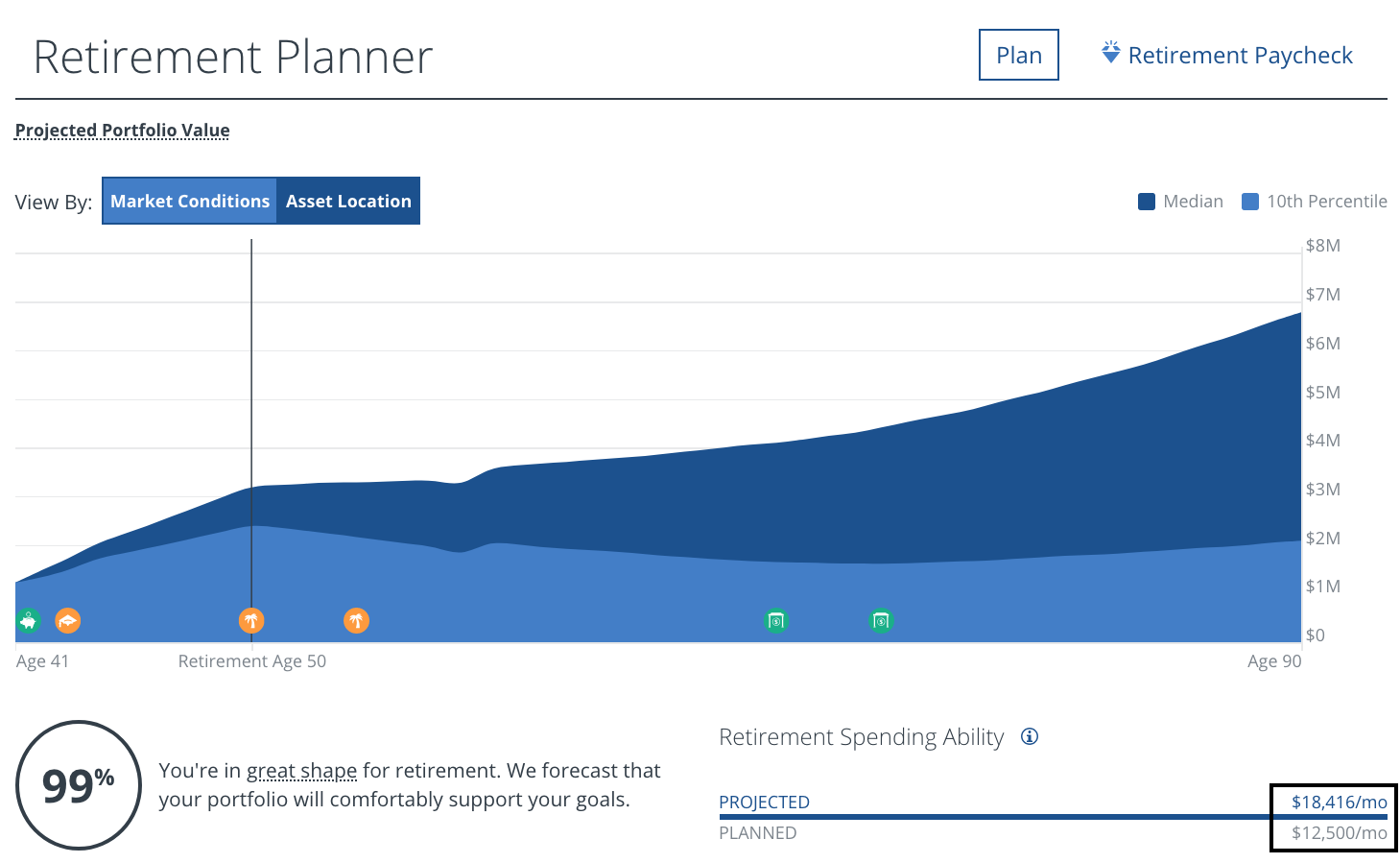

One of the best ways to feel rich and stay rich is to track your net worth with Personal Capital. I’ve been using Personal Capital’s free financial tools to optimize my wealth since 2012. It’s the best free money management tool on the web.

Just link up all your financial accounts to measure your cash flow, x-ray your portfolio for excessive fees, calculate your retirement income, and more.

Get you finances right the first time around. There’s no rewind button in life. Once you do, you can focus on the other things that truly matter in your life.

Personal Capital’s Free Retirement Planner

Invest In Real Estate To Feel Rich

I feel rich investing in real estate given it rides the inflation wave. It feels great to own a tangible asset you can see and touch. Real estate is a core asset class that has proven to build long-term wealth for Americans. Further, real estate provides utility and a steady stream of income.

Given interest rates have come way down, the value of rental income has gone way up. It now takes a lot more capital to generate the same amount of risk-adjusted income.

Take a look at my two favorite real estate crowdfunding platforms.

Fundrise: A way for all investors to diversify into real estate through private eFunds and eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. During times of volatility, Fundrise investments tend to outperform. For most people, investing in a diversified eREIT is the simplest way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have more capital, you can build your own select real estate fund with CrowdStreet.

Both platforms are free to sign up and explore.

I’ve personally invested $810,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Related posts:

How To Feel Rich Even If You Can’t Technically Get Rich

What Income Level Is Considered Rich

Readers, when do you feel rich? What is the one common thing that ties feeling rich together? What are some recent examples that made you feel like the richest person in the world? For more nuanced personal finance content, join 50,000+ others and sign up for my free weekly newsletter.

[ad_2]